We believe transparent data is the cornerstone of trust. The following information highlights the key features of our service:

₹2,000 to ₹1,00,000

We offer a wide range of loan amounts designed to meet diverse financial needs, from everyday emergencies to larger financial pursuits. Whether you're covering an unexpected expense or planning a family vacation, you can find an amount that matches your situation's unique demands.

Annual interest rates 16% – 32%

Interest rates must strike a fair balance. Our "lower than" interest rate is expertly structured for your credit profile and repayment capacity. By carefully evaluating your borrowing history, we identify consistently good borrowers. You'll see a credit score, a positive repayment history, or the potential for a financially healthy relationship reflected in our rates. Loans at or near the minimum (16%.) Your creditworthiness deserves to be rewarded.

Typically < 24 hours | Can be under 10 minutes for qualified users

We strive for 100% our "financial calculator." Through extremely detailed estimates and seamless coordination with banking systems, once approved—especially if you're a returning or financially savvy applicant—we can have verification and credit funded for advancing the repayment. We strive to keep our data delivery system updated to prevent delays from jamming.

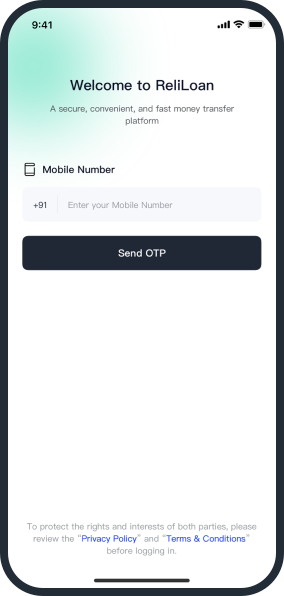

Say goodbye to cumbersome procedures and long waiting times. With the fast-loan App, you can securely and efficiently obtain the funds you need in just three simple steps, easily addressing various financial needs.

Download the ReliLoan App from the official app store and complete a swift registration using your mobile number.

Fill in your basic personal details, occupation information, and provide a PAN or a passport or lic platform.

Carefully review pricing and lending guides, select the appropriate loan amount and repayment terms when the available credit limit.

This was my first time applying for a loan, and I was worried the process would be complicated. But ReliLoan's interface is so user-friendly, it feels like having someone guide you step-by-step. I successfully received a credit limit even without any credit history. For a beginner, this is the most stress-free way to start.

Rating: ⭐⭐⭐⭐⭐

My shop urgently needed cash to restock, and customers were waiting. From application to receiving the money, it took only 22 minutes—I never even left my counter. This tool is practically tailor-made for business people.

Rating: ⭐⭐⭐⭐⭐

I'm using it for the third time now. Because I repaid on time every time, the system automatically offered me a higher credit limit and a lower interest rate this time! It feels amazing, just like a reward mechanism. Loyalty really pays off.

Rating: ⭐⭐⭐⭐⭐

My credit history isn't perfect, but ReliLoan still considered my application. While the interest rate wasn't the lowest, the terms were very clear, giving me an opportunity to access funds responsibly and rebuild my credit.

Rating: ⭐⭐⭐⭐⭐

As a recent graduate, I needed funds to purchase a professional course for skill development. The loan amount ReliLoan provided perfectly met my needs. This was an investment truly worth making.

Rating: ⭐⭐⭐⭐⭐

A: Typically, you need to be an Indian citizen, aged between 18 and 65 years, with a stable source of income and valid identity proof.

A: Your true interest rate will also, in this range, is determined through a personalized assessment by our system based on your credit profile, income level, and application information. All fees will be clearly displayed during the application process.

A: Late payments will incur a late fee of 1% per day on the overdue amount, which can significantly increase your repayment burden. We strongly advise making payments on time to avoid such charges and maintain a good credit score.

A: Absolutely. We protect all your data with advanced end-to-end technology and strictly adhere to Indian data protection regulations.

A: Once our application is approved, our goal is to finalize the funds in your designated bank account within 24 hours. Many users experience even faster disbursals for repeated loan usage.

A: Yes, we allow and encourage early loan repayment. You! No rebates on our pre-payment policy, exceeding any applicable charges, please refer to your loan agreement. We are committed to transparency.

A: Our approval process is highly automated and designed to be extremely unobtrusive. Therefore, we do not contact your employer.